Lines 33 - 36 Center for Agricultural Law and Taxation

Farmers total all expenses reported on Part II of the Schedule F and report the total on Line 33, Schedule F. Example 1. Georgia has $652,435 of total allowable farm expenses this year. She reports this total on Line 33, Schedule F. Net farm profit or loss is reported on Line 34, Schedule F. This is calculated by subtracting Total Expenses (Line 33, Schedule F) from Gross

Lines 33 - 36 Center for Agricultural Law and Taxation

Watch Bloomberg Markets: Asia 03/01/2024 - Bloomberg

Government of Canada releases draft Clean Electricity Regulations aimed at achieving net-zero emissions from Canada's electricity grid by 2035 – Obligations for electricity generators

The Global Food System: Trends, impacts, and solutions

Poverty in the United States - Wikipedia

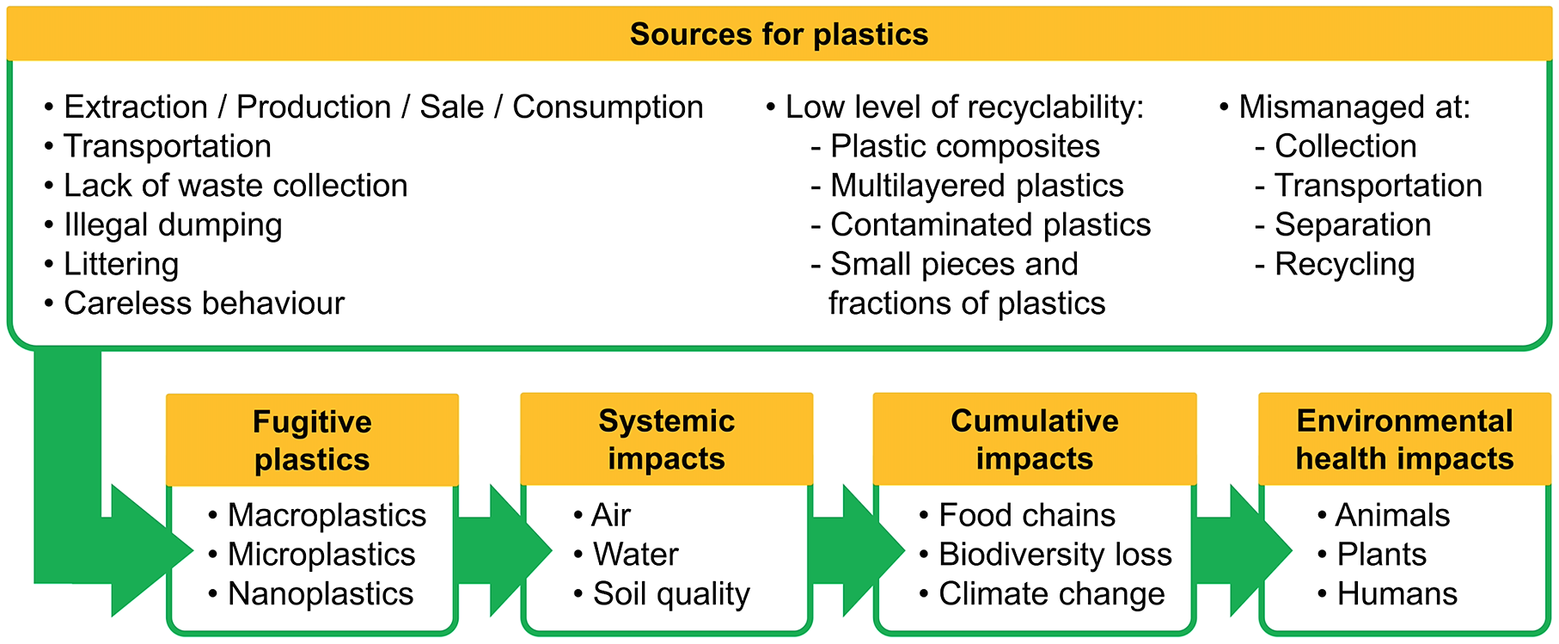

Global plastic pollution and informal waste pickers, Cambridge Prisms: Plastics

Issue Brief: Water Resource Issues, Policy and Politics in China

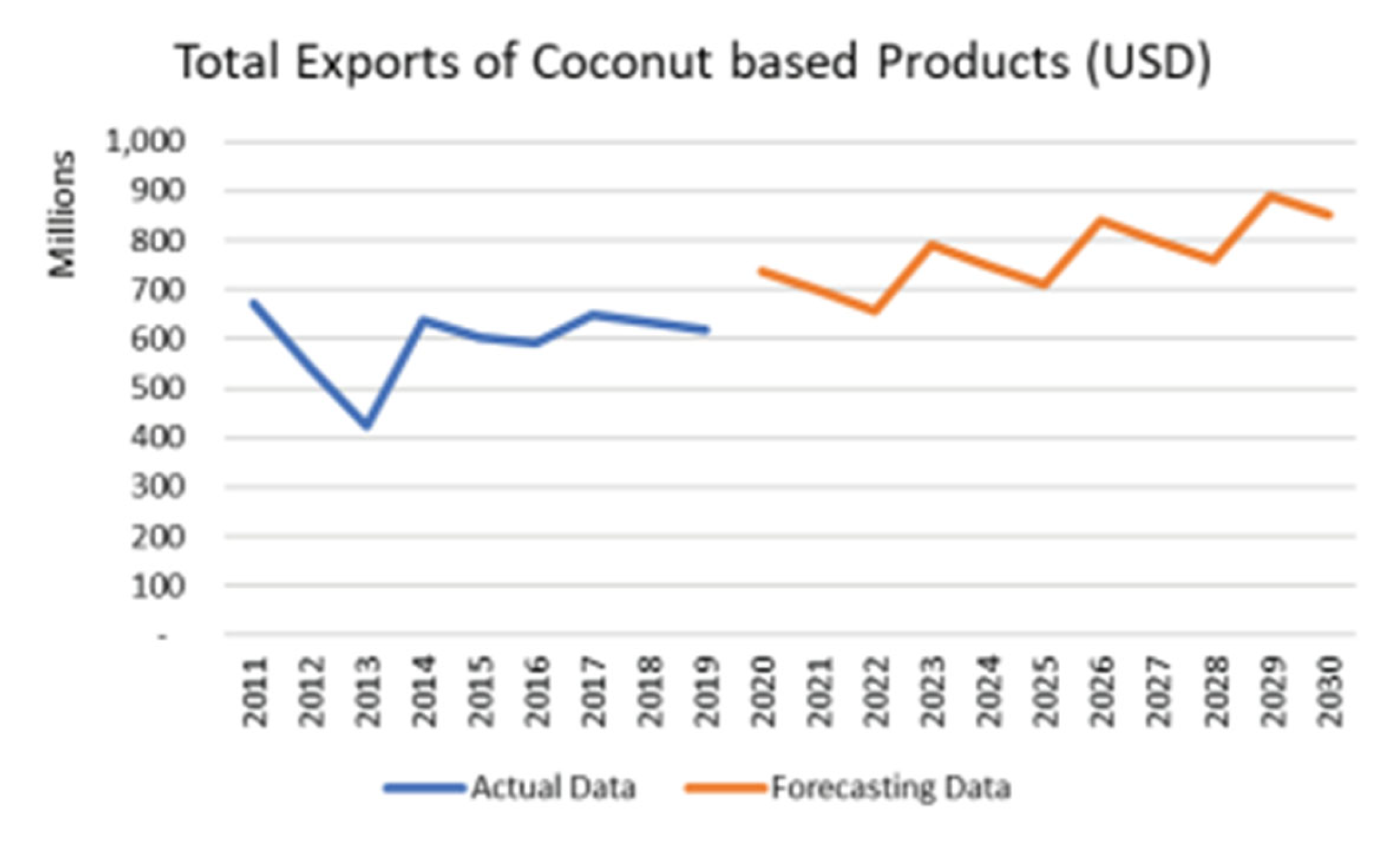

Economies, Free Full-Text

Taxation in the United States - Wikipedia

Agriculture in Russia - Wikipedia

Practical Law Global Guide: Doing Business in Ireland - Arthur Cox LLP

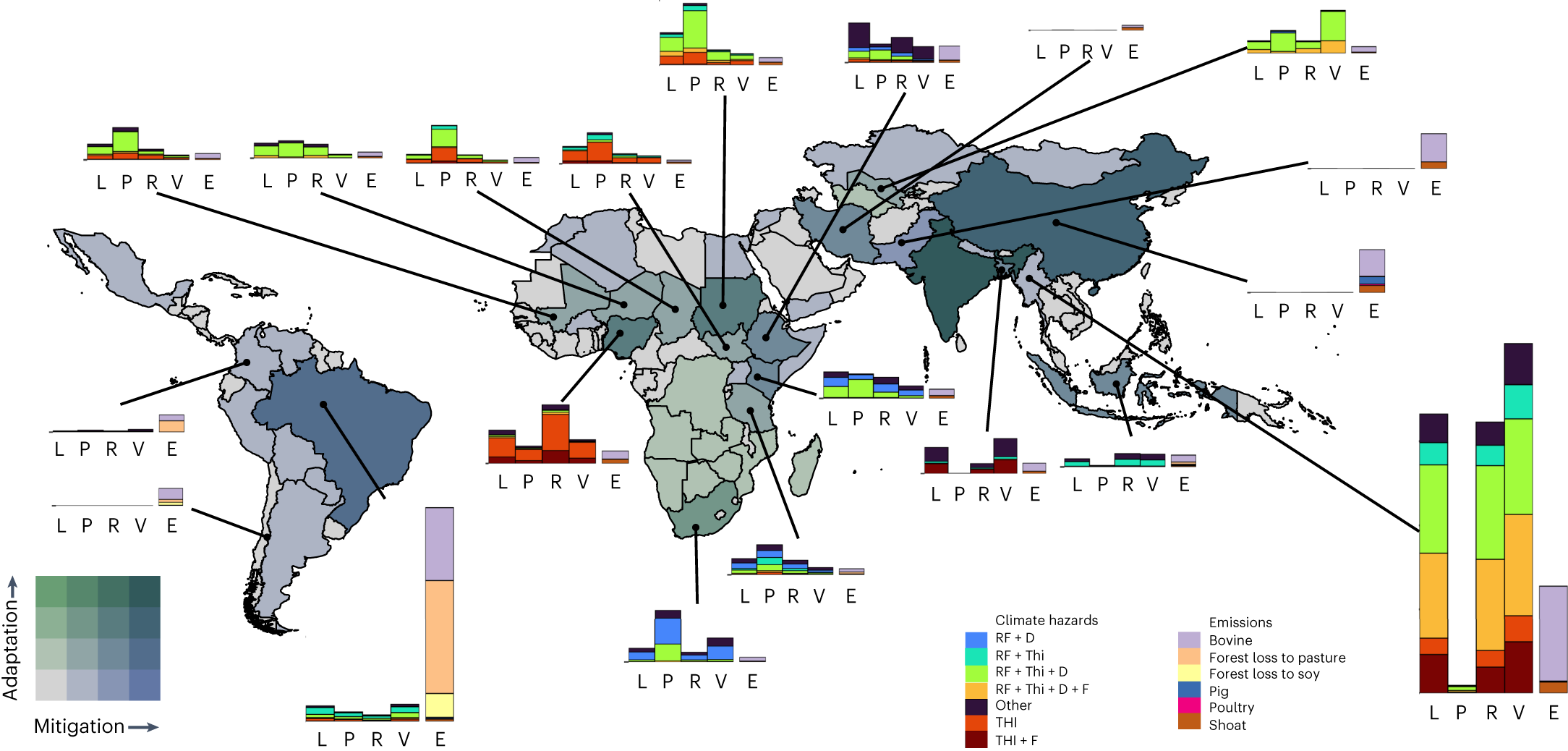

Priority areas for investment in more sustainable and climate-resilient livestock systems

Agriculture, Free Full-Text