Hanesbrands: Reducing Inventory Is The Key To A Turnaround (NYSE:HBI)

Hanesbrands' priority is to reduce inventory which will help its gross margins and debt issues. Click here to see why HBI stock is a Buy.

Hanesbrands' priority is to reduce inventory which will help its gross margins and debt issues. Click here to see why HBI stock is a Buy.

HBI -- Is Its Stock Price A Worthy Investment? Learn More.

Hanesbrands Q2: Is Reduced Inventory, Market Upheaval Shaping the Future?

Hanesbrands falls from preferred acquirer to prodded seller

Hanesbrands: Decline In Progress (NYSE:HBI)

HanesBrands: Dressed For Trouble With Champion In Tow (HBI)

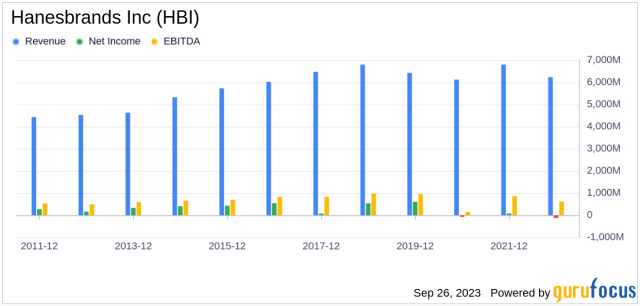

Hanesbrands: Turnaround Opportunity For This Extremely Undervalued Stock ( NYSE:HBI)

Is Hanesbrands Inc (HBI) Set to Underperform? Analyzing the Factors Limiting Growth

Hanesbrands: Turnaround Opportunity For This Extremely Undervalued Stock ( NYSE:HBI)

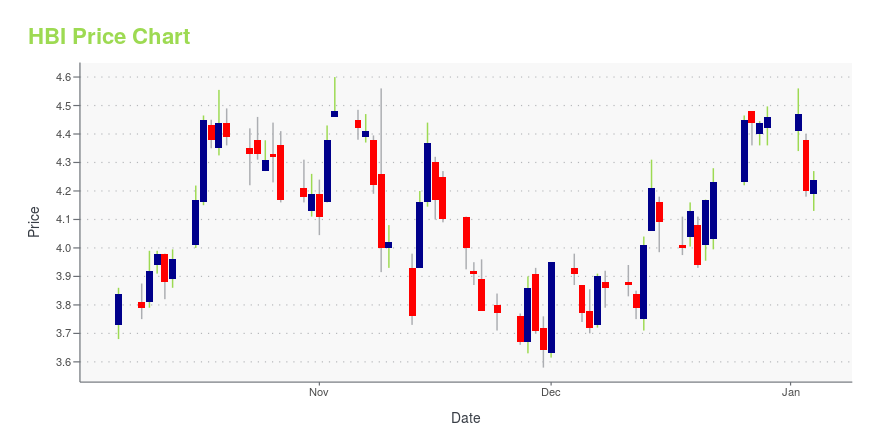

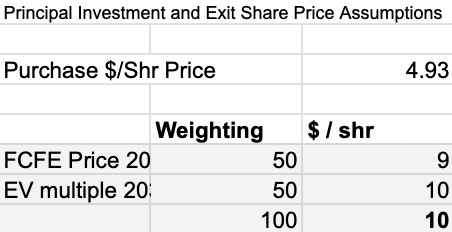

Our new investment idea: Hanesbrands Inc (NYSE: HBI)

Hanesbrands: Turnaround Opportunity For This Extremely Undervalued Stock ( NYSE:HBI)

Hanesbrands: Temporary Headwinds, Long-Term Value (NYSE:HBI)

Hanesbrands: Turnaround Intact, 4.3% Yield Is Attractive (NYSE:HBI)