Options Vega - The Greeks - CME Group

Learn about the Greek letter Vega, which measures an option’s sensitivity to implied volatility, and its role in options strategies.

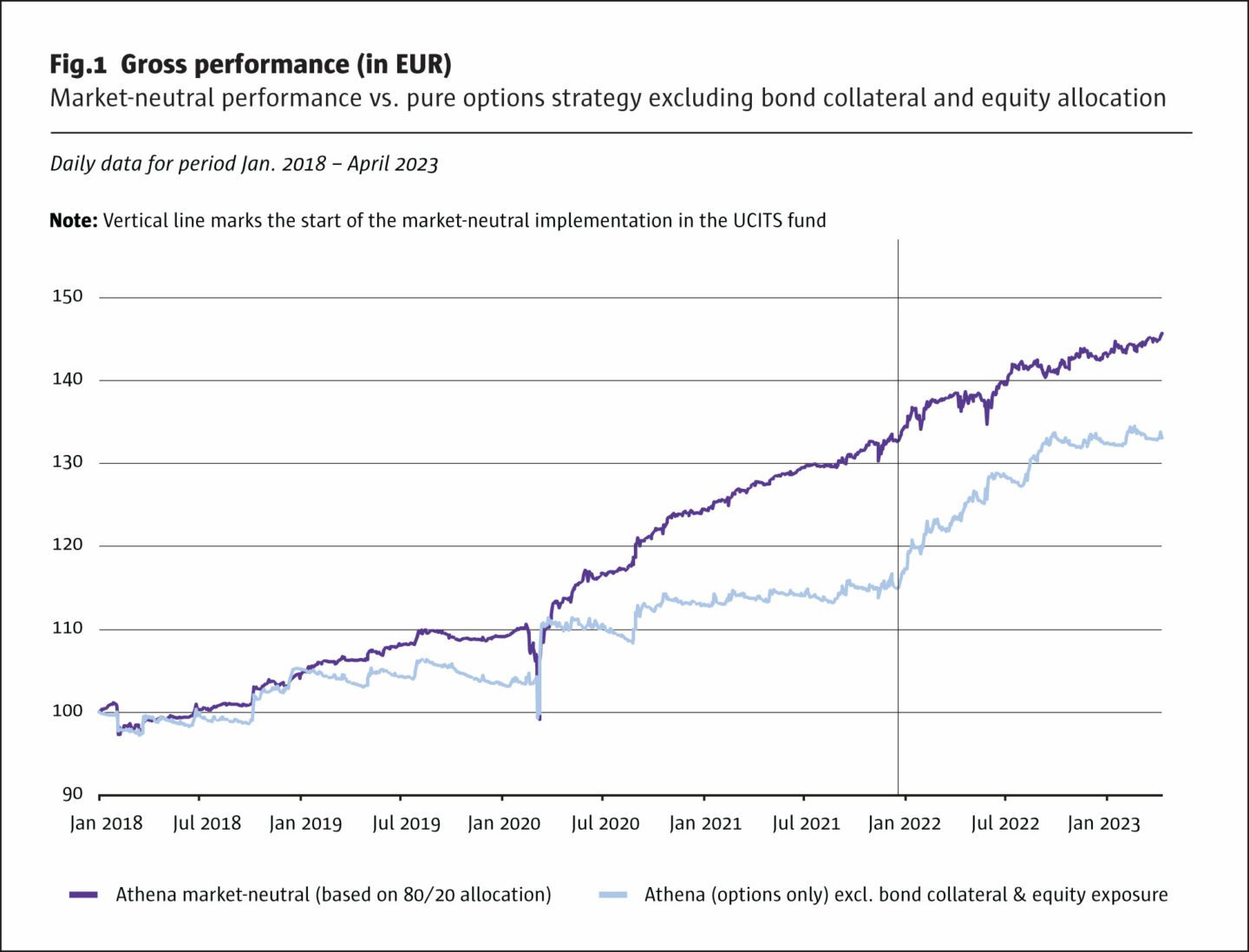

LeanVal's Volatility Relative Value Strategies · The Hedge Fund Journal

Why is Stock Vega Neutral?

Vega: Unlocking the Power of Vega in Credit Spread Options - FasterCapital

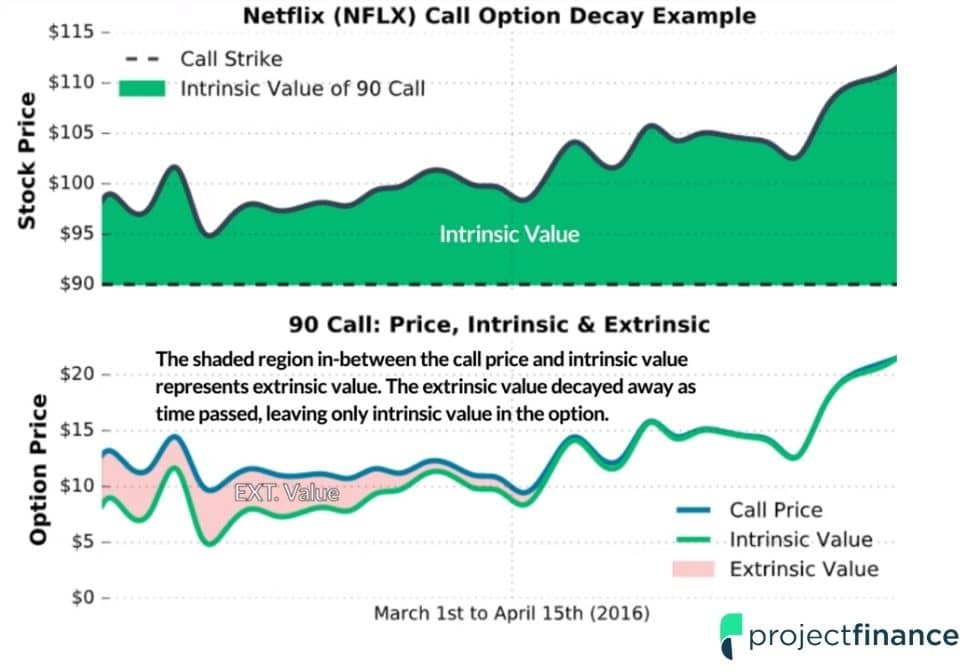

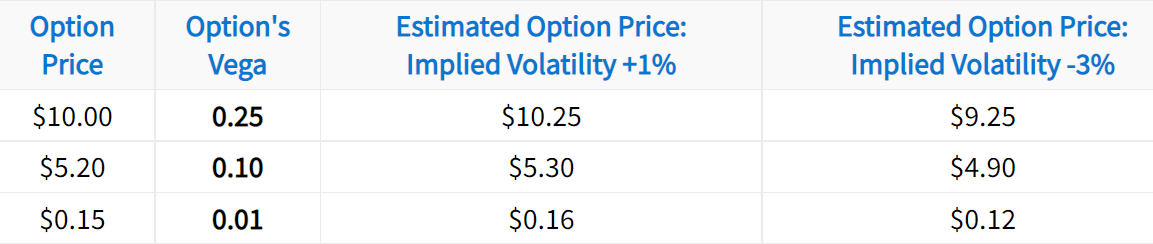

Option Vega Explained (Guide w/ Examples & Visuals) - projectfinance

The Greeks for Beginners: Delta, Gamma, Theta & Vega - projectfinance

GitHub - CJuanvip/CMEOptions: Analyze the CME grain options markets in python

Option Greeks: Delta, Gamma, Theta, and Vega

Option Vega Explained (Guide w/ Examples & Visuals) - projectfinance

Trading Equity Derivatives 101: What Are the Greeks?

What is Vega in Options Greek?. Vega is a variable that is used for…, by Shrikant Algoiq

:max_bytes(150000):strip_icc()/putoption-Final-37c324dca2c64f1b90eb19f979e1a57d.jpg)

Option Greeks: The 4 Factors to Measure Risk