Qualified Vs Non-Qualified ESPPs

Qualified vs Non-qualified ESPPs. We take you through an explanation of what they are, their differences and which one is best for you as an employee.

This post explains the two main types of employee stock purchase plans (ESPPs), detailing the differences between them and their tax implications.

How non-qualified plans differ from Section 423 plans. Learn more in our study., Emily Cervino, CEP posted on the topic

ESPP: The Five Things You Need to Know

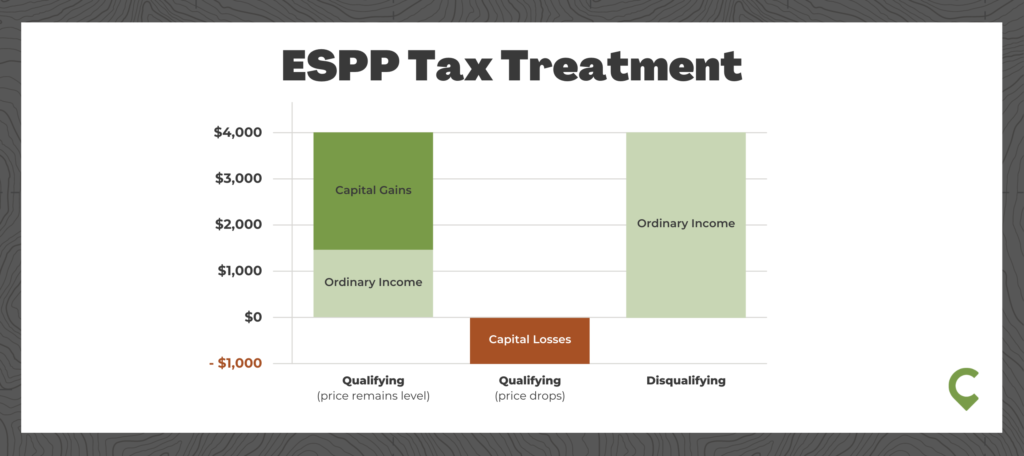

Tax, Accounting and Startups — Tax Treatment of ESPP

Stock Purchase - FasterCapital

Timing is Everything: The Importance of ESPP Stock Purchase Dates - FasterCapital

ESPPs Uncovered: Qualified vs: Non Qualified Plans - FasterCapital

Qualified Vs Non-Qualified ESPPs

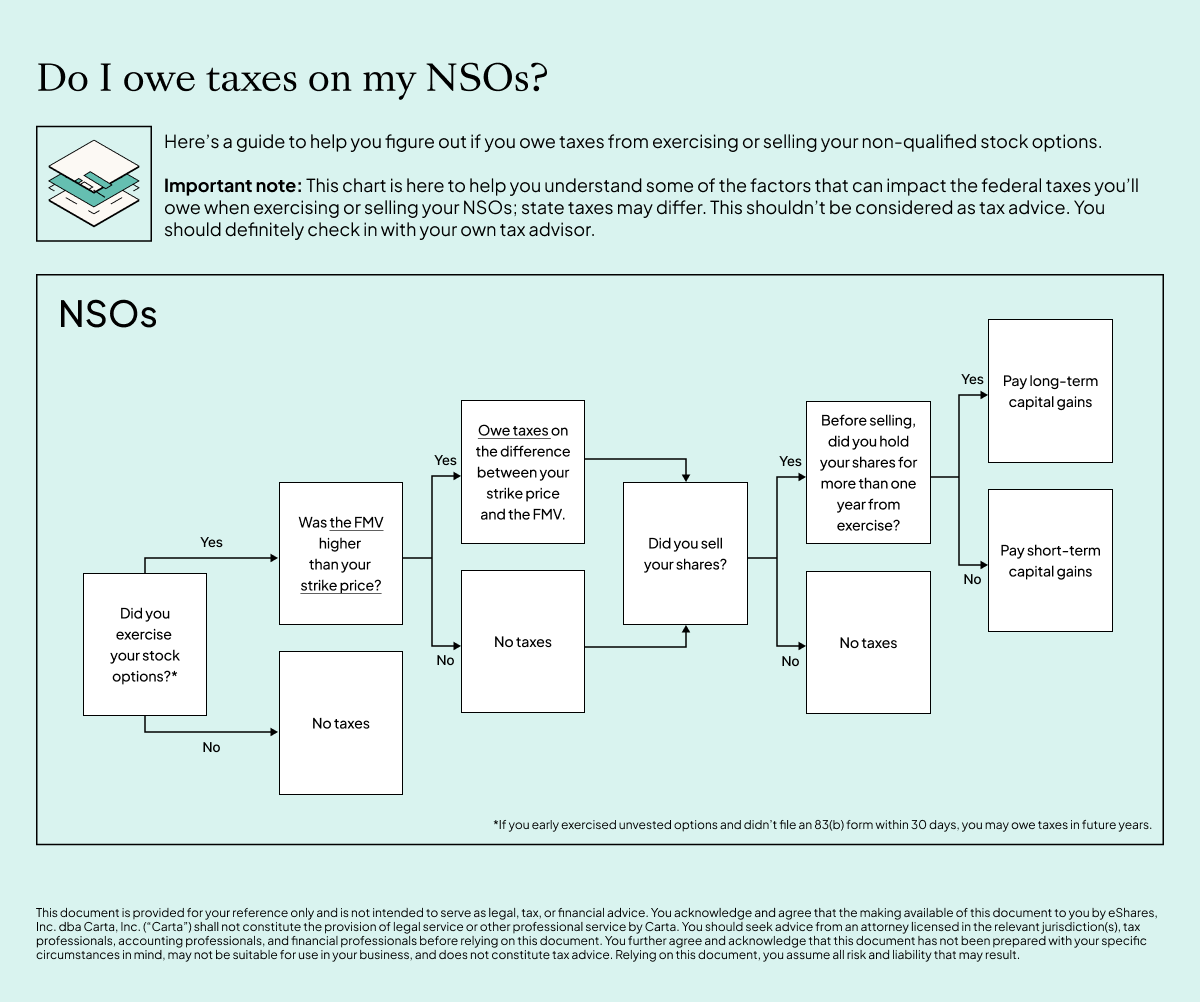

Non-Qualified Stock Options (NSOs): How NSOs Work

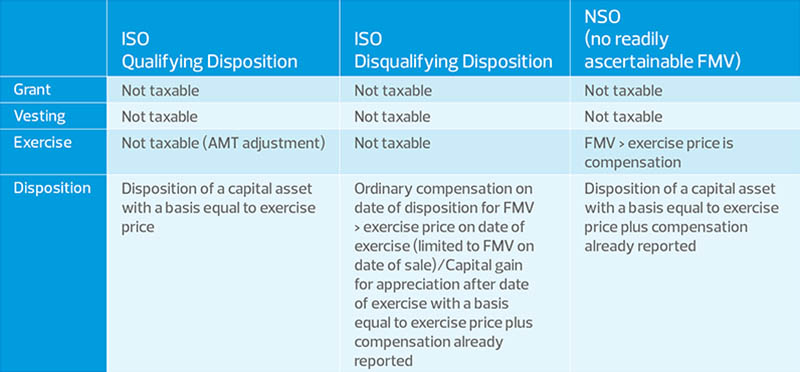

Introduction To Espps And Qualified Dispositions - FasterCapital

Frequently asked questions about stock options and tax implications

Employee stock purchase plans (ESPPs) and taxation: An overview of the rules and regulations

Qualified Vs Non-Qualified ESPPs

All About ESPPs - Financial Planning Fort Collins