Calendar Spreads in Futures and Options Trading Explained

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)

A calendar spread is a lower-risk options strategy that profits from the passage of time or an increase in implied volatility.

What are Calendar Spread and Double Calendar Spread Strategies

Box Spread - Definition, Example, Uses & Hidden Risks

:max_bytes(150000):strip_icc()/139085474-5bfc2b8d46e0fb0026016ee7.jpg)

Reverse Calendar Spread: What it is, How it Works, Example

Calendar Spread Options Trading Strategy In Python

What are Calendar Spread and Double Calendar Spread Strategies

Calendar Call: Definition, Purpose, Advantages, and Disadvantages

:max_bytes(150000):strip_icc()/216077-garlic-bread-spread-step-3-BP-3151-ec982d13b39f45c5ab1735efd8238b34.jpg)

Spread

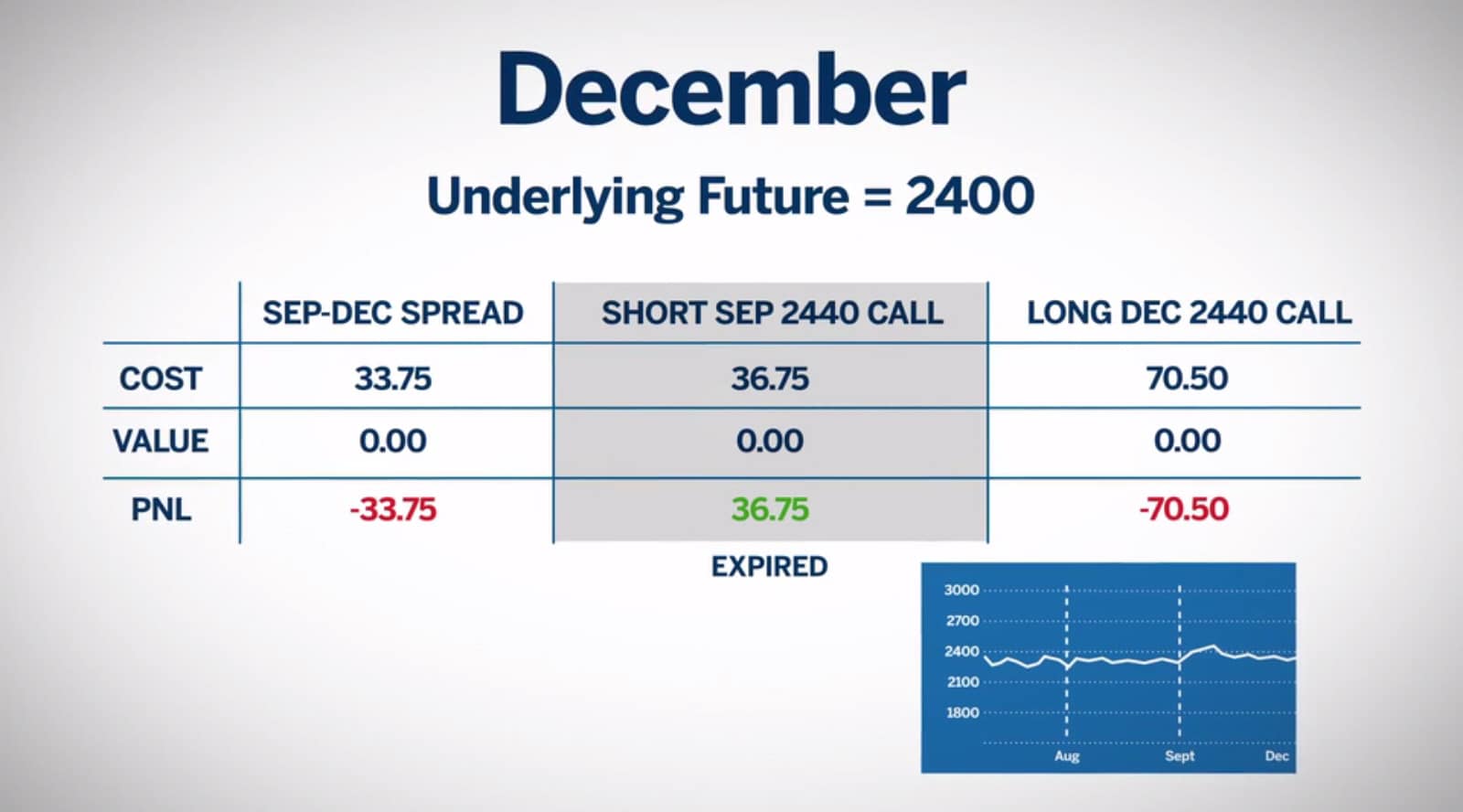

Option Calendar Spreads - CME Group

/wp-content/uploads/2023/10/image-1.

:max_bytes(150000):strip_icc()/Covered-call-etfs-7975323_final-812d15db8dc0431a89588d0d181953df.png)

Options & Derivatives Trading

:max_bytes(150000):strip_icc()/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

James Chen

Options Trading Strategies: Exploring the Reverse Calendar Spread - FasterCapital

Options Trading Strategies: Exploring the Reverse Calendar Spread - FasterCapital

Box Spread Definition: Day Trading Terminology - Warrior Trading