What Is Form 8586: Low-Income Housing Credit - TurboTax Tax Tips

General business tax credits provide incentives for business activities beneficial to the American public or the economy in general. Owners of rental buildings in low-income housing projects may qualify for the low-income housing credit, which is part of the general business tax credit, using Form 8586 to calculate the amount of the credit.

Rules For Claiming A Dependent On Your Tax Return TurboTax, 53% OFF

IRS Form 8586 Walkthrough (Low-Income Housing Credit)

TurboTax Deluxe Federal + efile 2009 [Old Version] Price in Pakistan-Home Shopping

TurboTax® Business Desktop 2023-2024

Apple With Medical Pulse Logo Health Apple Creative Logo, 40% OFF

Free Legal Services Available For Low-income Residents, 40% OFF

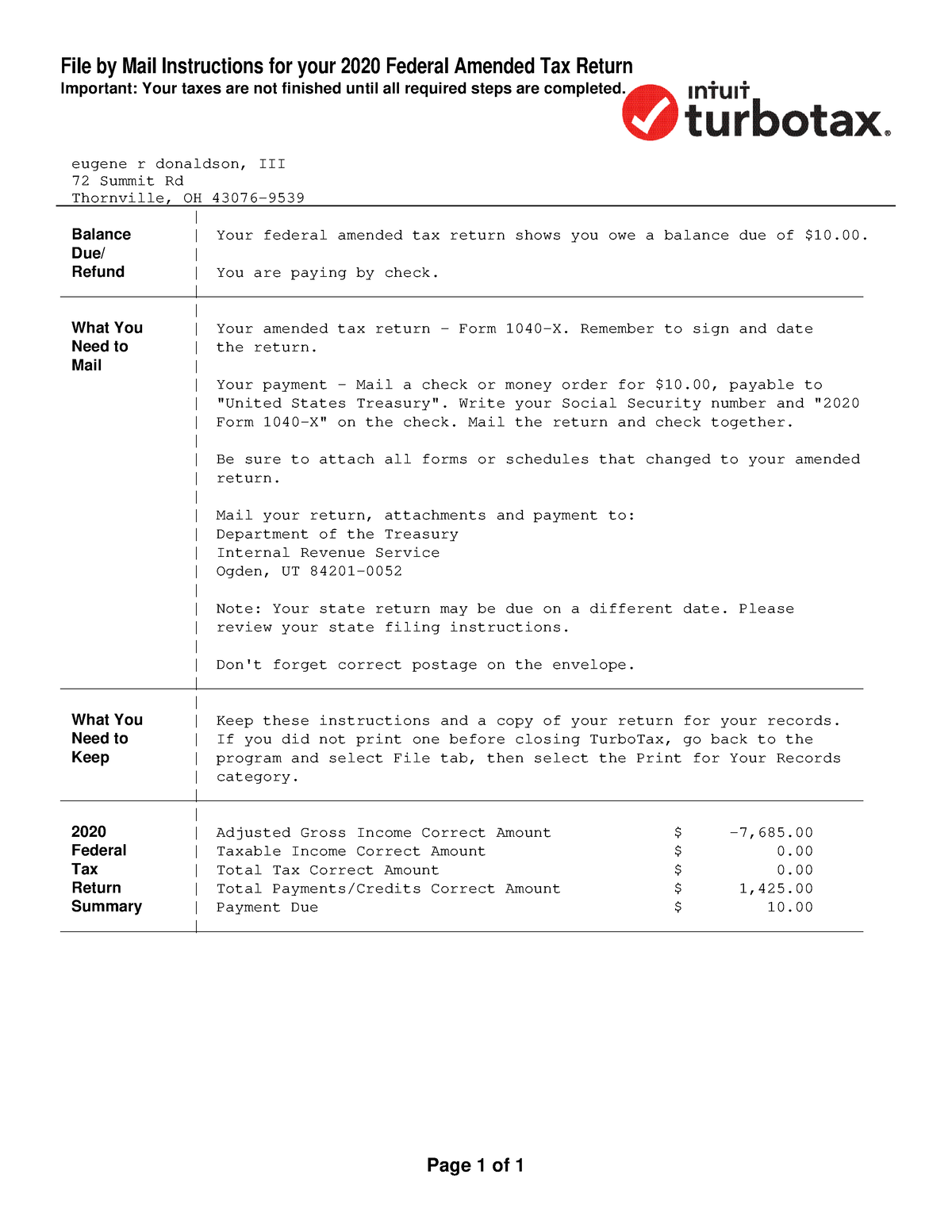

Tax Return - i want to fuck - File by Mail Instructions for your 2020 Federal Amended Tax Return - Studocu

American Express No Fee Travel Credit Card

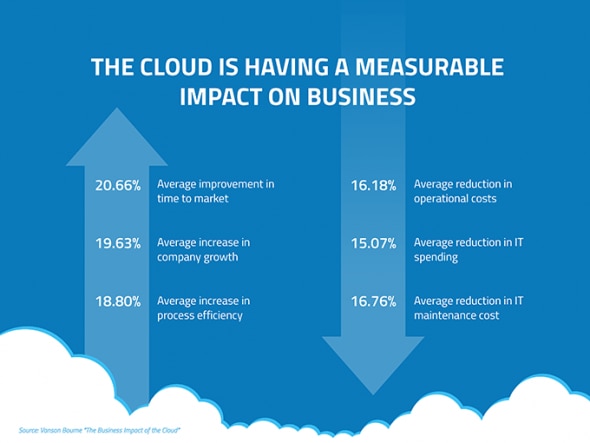

Small Business Disaster Recovery In The Cloud

nlp-question-detection/queries-10k-txt at master · kartikn27/nlp-question-detection · GitHub

Are GI Benefits Considered Income On Your Tax Return?, 42% OFF

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 58% OFF

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 58% OFF