Tapestry amends outlook on soft US demand as Capri merger moves ahead

Strong sales in Asia, particularly China, helped to partially offset flat North America revenues driven by a wholesale dip. The Capri deal is on track for 2024.

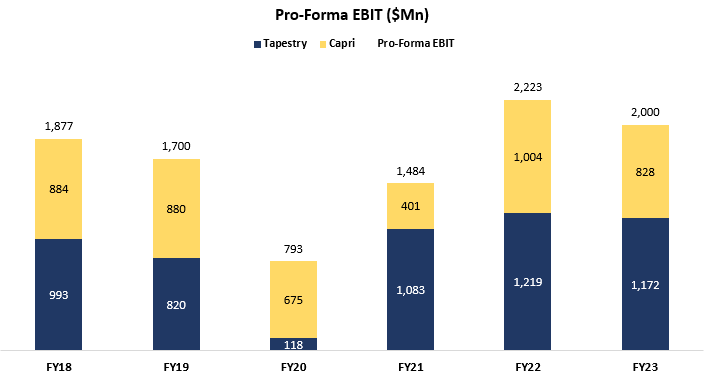

Tapestry Stock: Capri Acquisition Raises Multiple Red Flags

Capri Vogue Business

Paul Rousseas on LinkedIn: Tapestry amends outlook on soft US demand as Capri merger moves ahead

Where to shop: Why doesn't anyone know where to shop anymore?

ny20010074x1-pc_1.jpg

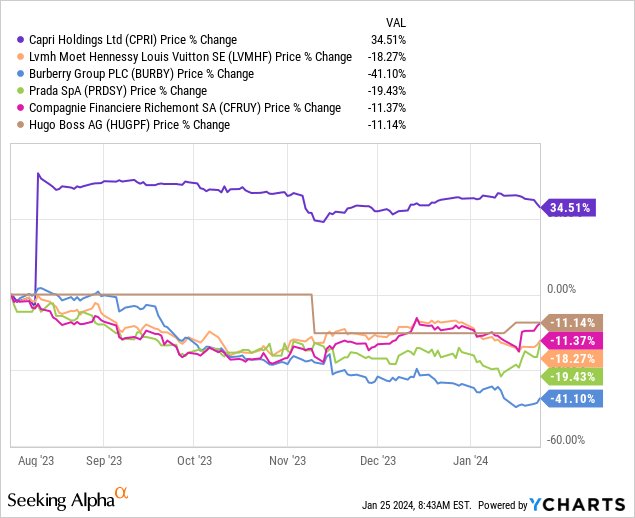

Capri Holdings Stock: Trading With 14.8% Upside To The Tapestry Deal Price (NYSE:CPRI)

.jpg)

The discounting frenzy is in full swing. Who will come out on top?

Tapestry, Inc. Acquires Capri Holdings for $8.5 Billion - Fashionista

Fashion Companies: News, Insights & More, Vogue Business, Page 3

logo_capri.jpg

Fashion Companies: News, Insights & More, Vogue Business