Millennial Money: Navigating the SSI 'marriage penalty', National

For people who rely on Supplemental Security Income, or SSI, getting married can result in reduced monthly benefits and a lower amount allowed for savings. Individual SSI recipients can own up to $2,000 in resources, while couples can have a combined $3,000. Though these limits can dissuade some couples from marrying, exemptions for assets such as primary residences and wedding rings can help bypass these kinds of restrictions. Social Security programs such as Plan to Achieve Self-Support and Achieving a Better Life Experience also offer flexible savings avenues.

Solemn monument to Japanese American WWII detainees lists more than 125,000 names - Richmond News

Navigating the SSI 'marriage penalty

Taxation « William Byrnes' Tax, Wealth, and Risk Intelligence

The Demise of the Happy Two-Parent Home - The Demise of the Happy Two-Parent Home - United States Joint Economic Committee

Gov. Gretchen Whitmer has 26 times the campaign cash Tudor Dixon does

UN weather agency issues 'red alert' on climate change after record heat, ice-melt increases in 2023 - SRN News

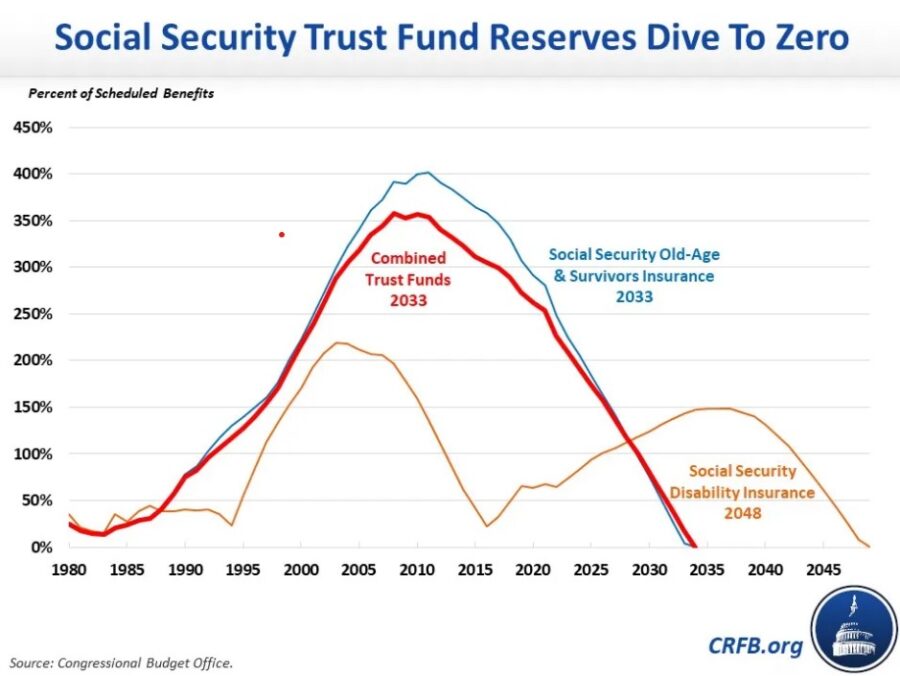

Third rail' heats up as Social Security reform talk increases

Atmos Energy Hits Highest Customer Satisfaction Score Since 2018, as Energy Utilities See Gains, ACSI Data Show, Business & Finance

Trump's social media company approved to go public, potentially netting former president billions – Winnipeg Free Press

National Council on Disability